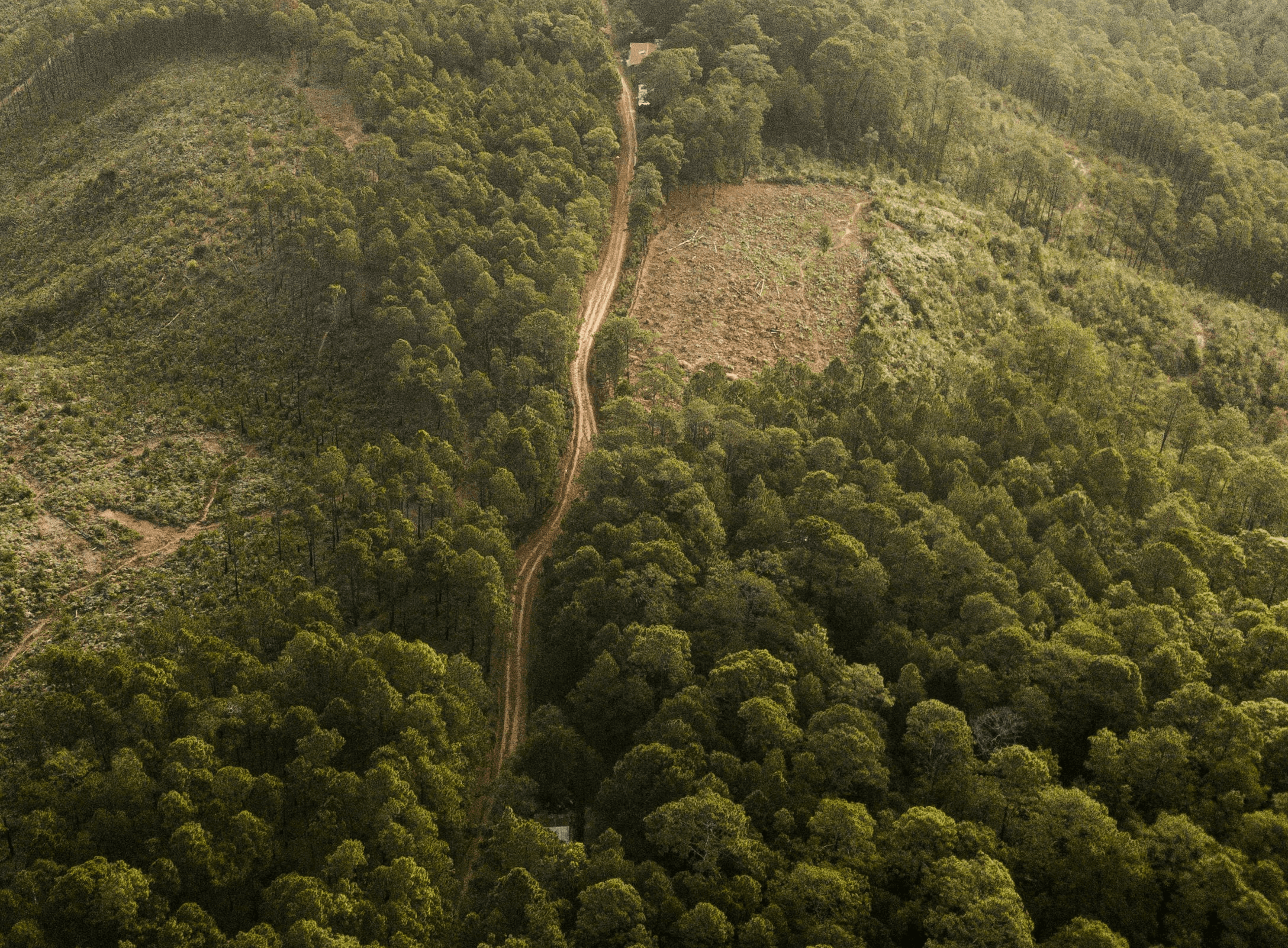

Photo credit: Karsten Winegeart via Unsplash

The EU Deforestation Regulation (EUDR) will reshape global supply chains starting on 31 December 2025, primarily impacting multinational corporations and large undertakings.

Note the delay in implementation, announced October 2024 by the European Commission. The regulation was supposed to be binding from the end of 2024 and has now been pushed out by 12 months.

The regulation targets seven key commodities and their derived products:

Cattle

Cocoa

Coffee

Oil palm

Rubber

Soya

Wood

You might be affected if your business deals with products like chocolate, leather, furniture, or even printed materials. The full list of products can be found in Annex 1 of the EUDR.

Definitions of ‘Operator’ and ‘Trader’ in EUDR

Under the EUDR, operators and non-SME traders must ensure their supply chains are deforestation-free. An operator is the entity that first places products on the market or exports them. A trader deals with products already on the market. The EUDR covers both imports and exports, meaning due diligence is required for commodities and products leaving the EU as well.

Here are some examples.

Proposed delays

While the regulation aims to combat deforestation, a global issue, a worldwide consensus has yet to be reached. Early this year in the US, the Biden administration has raised concerns about potential trade disruptions resulting from EUDR, whilst China has refused to provide critical geolocation data required for compliance. Meanwhile, countries like Brazil, Malaysia and Indonesia are also pushing for delays, worried about the impact on smallholder farmers who may struggle to meet the stringent requirements. Even within the EU, Germany requested a six-month postponement to July 2025, citing worries about insufficient time for companies to prepare for the new regulation.

It was proposed by European Commission in October 2024 that the regulation would be delayed by 12 months:

30th December 2025 for large operators and traders

30th June 2026 for small and micro enterprises

The current landscape

As it stands, from 29 June 2023, all countries are considered "standard risk" until official country-level risk classifications are released by the European Commission. This means regular due diligence – information collection, risk assessment, and mitigation (if needed) – is required across the board. Even with the regulation being postponed, getting ahead now can provide significant advantages.

Photo credit Esteban Benites via Unsplash

The European Commission is expected to release guidance by the end of 2024 on the risk level of different countries, classifying them as low, standard or high-risk. Whilst simplified due diligence (Article 13) will eventually apply to ‘low-risk’ countries, businesses cannot afford to wait. With every country currently labelled as standard risk, comprehensive due diligence processes are demanded that can be scaled or adjusted as classifications are finalised.

Tackling the data collection challenge

At the heart of EUDR compliance lies an unprecedented data gathering effort. Companies must trace their products back to the plot-of-land level, providing geolocation data (latitude/longitude) that proves no deforestation occurred after 31st December 2020. This requirement necessitates the exploration and implementation of advanced tools such as satellite imagery, aerial photography, and field-level data collection methods.

Early engagement with suppliers is crucial, especially given potential resistance to sharing detailed data, as per China's current stance. Companies must develop strategies to overcome these challenges, potentially through capacity building, incentive programs, or alternative verification methods.

Mapping your supply chain's deforestation exposure

The impact of EUDR extends beyond direct importers, affecting the entire value chain. Businesses must first determine their role within the regulation — whether they're classified as operators, traders, or indirectly affected entities. This classification will dictate different levels of compliance requirements.

A comprehensive mapping of N-tier suppliers is essential to identify which entities fall under EUDR requirements. We strongly advise companies that are not directly affected by the regulation to review their suppliers' compliance to EUDR in order to manage reputational and operational risks effectively.

Furthermore, companies must consider the EUDR in the context of other regulatory frameworks, such as Germany's Supply Chain Act (LkSG) and the upcoming EU Corporate Sustainability Due Diligence Directive (CSDDD). A holistic approach to compliance can help streamline efforts across multiple regulatory requirements.

Building a robust due diligence system

Proactive preparation is key to long-term compliance and can offer competitive advantages. Companies should develop comprehensive due diligence systems that encompass:

Information collection protocols

Risk assessment methodologies & supply chain traceability

Mitigation measure frameworks

Ongoing monitoring and updating processes

Certification schemes like Rainforest Alliance or FSC are often viewed as helpful tools under the EUDR for managing risk and enhancing due diligence. However, these schemes alone are not enough to ensure compliance. Gaps in areas like complete deforestation prohibition and traceability mean that companies must implement comprehensive due diligence processes beyond relying solely on certification schemes or other voluntary sustainability standards.

In short, voluntary certifications are helpful but not mandatory; they should be seen as a complement to, not a substitute for, the robust due diligence system the EUDR demands.

Suggested actions to take in Q4 2024

1️⃣ Assess your EUDR status Determine whether your business operates as an importer/exporter of EUDR commodities or products, or if you are indirectly impacted through your supply chain.

2️⃣ Start supply chain mapping Focus on mapping your supply chain, with a priority on high-risk areas that are most likely to be impacted by EUDR regulations.

3️⃣ Engage suppliers early Begin communication with your suppliers to clarify data requirements. If you’re an operator/trader, prepare your Due Diligence Statement. If indirectly affected, ensure you monitor your suppliers' compliance.

4️⃣ Build strong systems for information management Implement and enhance due diligence information management systems to streamline compliance processes and maintain accurate, up-to-date records.By following these steps, your business will be well-prepared for EUDR compliance, even in the face of potential delays or changes. Bendi is here to support you in navigating this evolving regulatory landscape, ensuring a more resilient and transparent supply chain.

✅ Click to download the Bendi decision guide on EUDR for further guidance.

(Potential) EUDR implementation dates, as of October 2024

November 2025: Due Diligence Statement (DDS) registration opens

December 2025: DDS information system launches; country risk classifications released

30 December 2025: EUDR applies to large operators and traders

30 June 2026: EUDR applies to SMEs; impact assessment for potential expansion to other commodities e. g. biofuels and other natural ecosystems eg. wetland, savannahs, peatlands